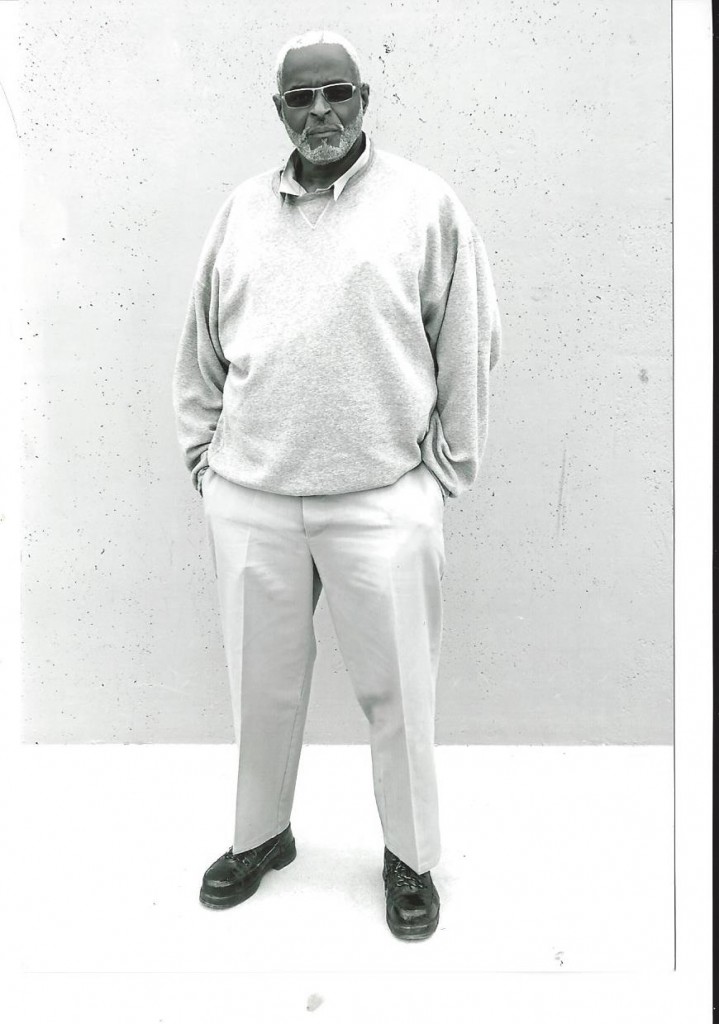

“The Elders Coroner.”

From the Elders Corner: Greetings Love one. My name is Eugene Wilson, I am presently incarcerated in the United States Penitentiary and have been for the last 23 years, on a 47 year sentence. My case involved 3.4 grams of crack and a gun. One might think that’s a great deal of time for such a small amount of drugs, but that’s not the reason for my writing………. Today I would like to acquaint myself with you so that you may get a better feel for who I am, why I am, for the reasons that I am. I don’t want you to dwell so much on my situation, for this is not what defines who I am. However it has proven to reveal the greatness that I am capable of. It was here where I became the Adviser of the M.E.N.S.T.O.P. Program. A position from it’s inception I haven’t taken lightly. Because I know when the young looks towards a elder to ask of his guidance especially in this day and Time) to be a Leader, guider and adviser, it’s not the asker that is asking it’s the Universe, God, Nature, Or whatever you may or may not believe in that is using that individual to show the need of you to solidify you with the “Universal” need for you. So I was not only profoundly honored when I was ask by D.J. (Demond Jackson) to take the position as the advisor of the M.E.N S.T.O.P. I knew that it was the Universe way of Calling me to do the work of that “It” had Fashioned me to do….. So, I am deeply honored to present to you “The Elders Coroner.” Where I will bring to you each month “Knowledge” from the elder, “Not Wisdom,” but “KNOWLEDGE”. Wisdom only comes out of the performance of Knowledge. There Forth I can not give you “wisdom” you must give wisdom to yourself by the big use of the knowledge that is given to you “OR” experience by you. Wisdom is the acting out of that Knowledge. This not only shows the wisdom you have obtained through the knowledge your receive, but it will also show that you have the understanding of it. Because you can only “Know,” that you “Know” what you “Know”, when you you’re “WISE” enough to “ACT OUT” what you KNOW. Maybe this is why they say. “Seek Wisdom, knowledge and understanding. But ABOVE “ALL” THINGS, SEEK UNDERSTANDING!! ………… Welcome to “The Elders Corner”